Saudi Aramco to Sell 1.5% Stake, Raise up to $25.6 Billion

Voice of America

17 Nov 2019, 17:35 GMT+10

DUBAI, UNITED ARAB EMIRATES - Saudi Arabia's state-owned oil giant Aramco announced Sunday it will sell a 1.5% stake in the company as it looks to raise as much as $25.6 billion from the sale.

The newly released figures also revealed a valuation for the company that's between $1.6 trillion and $1.7 trillion, a figure that fell short of the $2 trillion mark Crown Prince Mohammed bin Salman had sought.

Still, a 1.5% flotation could raise between $24 billion and $25.6 billion to help fuel the Saudi economy. Saudi Aramco announced it will have 200 billion regular shares, selling 1.5% or what is 3 billion shares.

Aramco set a stock price range of 30 to 32 Saudi riyals, or $8 to $8.50 a share for investors.

The company is selling 0.5% to individual investors, which will include Saudi citizens, residents of Saudi Arabia and Gulf Arab nationals, and 1% to institutional investors, which could include major Chinese and Russian buyers.

Aramco will announce the final price for the stock when the book-building period ends Dec. 5. Trading on the local Tadawul exchange in Riyadh is expected to happen sometime in mid-December.

Global buzz

The highly anticipated sale of a sliver of the company has been generating global buzz because it could clock in as the world's biggest initial public offering, surpassing record holder Alibaba whose IPO raised $21.8 billion on its first day of trading in 2014.

Saudi Aramco is the kingdom's oil and gas producer, pumping more than 10 million barrels of crude oil a day, or about 10% of global demand. The oil and gas company netted profits of $111 billion last year, more than Apple, Royal Dutch Shell and Exxon Mobil combined.

The kingdom's plan to sell part of the company is part of a wider economic overhaul aimed at raising new streams of revenue for the oil-dependent country, particularly as oil prices struggle to reach the $75 to $80 price range per barrel analysts say is needed to balance Saudi Arabia's budget. Brent crude is trading at just more than $63 a barrel.

Prince Mohammed has said listing Aramco is one way for the kingdom to raise capital for the country's sovereign wealth fund, which would then use that revenue to develop new cities and lucrative projects across Saudi Arabia.

Risks for investors

Despite Aramco's profitability, the state's control of the company carries a number of risks for investors.

Two key Aramco processing sites were targeted by rockets and missiles in September, an attack claimed by Iran-backed Houthi rebels in neighboring Yemen but which Saudi Arabia blamed on Iran. The government also stipulates oil production levels, which directly impacts Aramco's output.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Miami Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Miami Mirror.

More InformationBusiness

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

International

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

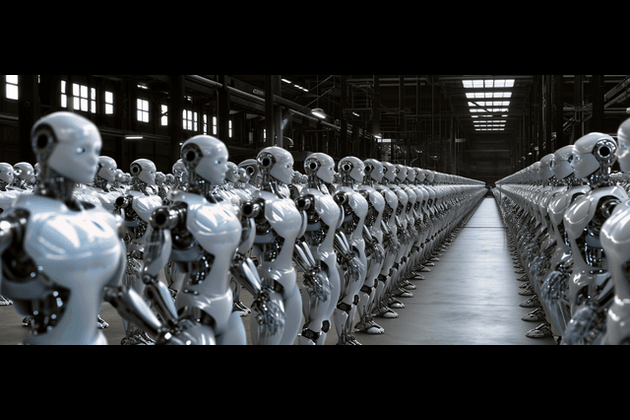

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

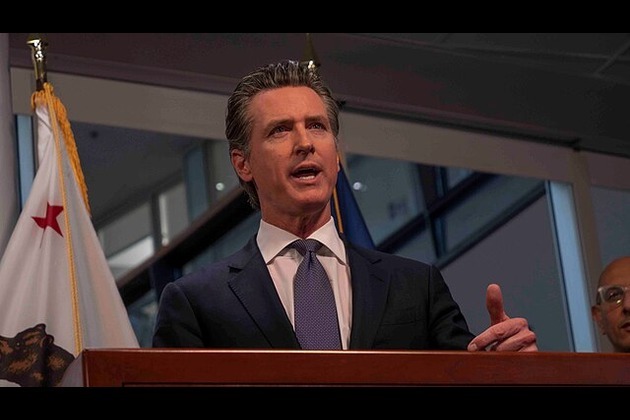

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...