Energy Recovery Reports Second Quarter Financial Results

ACCESS Newswire

31 Jul 2020, 01:35 GMT+10

SAN LEANDRO, CA / ACCESSWIRE / July 30, 2020 / Energy Recovery Inc. (NASDAQ:ERII) ('Energy Recovery,' 'we,' 'our,' or the 'Company'), a leader in pressure energy technology for industrial fluid flows, today announced its financial results for the second quarter ended June 30, 2020.

Second Quarter 2020 Highlights:

- Product revenue of $19.3 million, flat year-over-year and a sign of stability of the desalination industry in a period of global uncertainty

- License and development revenue of $24.4 million related to the termination of the license agreement between the Company and Schlumberger Technology Corporation ('Schlumberger')

- Product gross margin of 66.0%, a decrease of 550 basis points year-over-year, of which 370 basis points are due to COVID-19 temporary reductions in manufacturing

- Net income of $16.9 million, or diluted earnings per share of $0.30, an increase of $0.23 year-over-year, including $17.2 million, net of tax related to the termination of the license agreement between the Company and Schlumberger and the impairment of related long-lived assets.

Year-to-Date 2020 Highlights:

- Product revenue of $38.3 million, an increase of 8% year-over-year

- License and development revenue of $26.9 million of which $24.4 million is related to the termination of the license agreement between the Company and Schlumberger

- Product gross margin of 68.0%, a decrease of 250 basis points year-over-year

- Net income of $17.5 million, or diluted earnings per share of $0.31, an increase of $0.20 year-over-year, including $17.2 million, net of tax related to the termination of the license agreement between the Company and Schlumberger and the impairment of related long-lived assets.

'Our performance this quarter demonstrates the resiliency of our business and the capabilities of our team to adapt to unprecedented global circumstances. Despite these challenges, the continued growth of mega SWRO projects and conversion of thermal desalination facilities to SWRO is driving increased demand for our technology and concurrent growth in our revenue,' said Bob Mao, Chairman of the Board, President and CEO of Energy Recovery.

Mr. Mao continued, 'I am pleased with these results and continue to expect 20 to 25 percent year-over-year annual growth in our water segment. In addition, we remain focused on generating near-term shareholder value from our VorTeq technology. We are in a good place following our simulated frac test with Liberty Oilfield Services in June 2020, and we are approaching the challenges that remain, including completing two to three live well beta tests, in a disciplined manner. As with any R&D initiative, we will not hesitate to shelve or stop spending on efforts that do not meet the technical readiness, profit and ROI objectives that we have set.'

COVID-19 Pandemic

In early April 2020, following the Company's decision to temporarily suspend manufacturing activities at its San Leandro headquarters the last two weeks of March, the Company commenced limited manufacturing in accordance with federal, state and local regulations and guidance with enhanced safety measures in place, including staggered shifts to ensure social distancing between workers, personal safety equipment for each worker, including masks and gloves, cleanings and disinfections between and during shifts, and starting in July weekly testing of employees working on site. The Company resumed full production in May 2020 with enhanced safety measures remaining in place to contain the spread of COVID-19 and to first of all ensure the health and safety of its employees, as well as to protect Energy Recovery's business in the future.

While any effect of the pandemic has had only a limited effect on the Company's financials to date, the Company's gross margin for the first half of 2020 was negatively affected due to reduced production output while the plant was underutilized. Based on the Company's current rate of production, the Company believes that it will be able to fulfill our existing delivery obligations in fiscal year 2020 and beyond.

Second Quarter 2020

Revenues

For the second quarter ended June 30, 2020, the Company generated total revenue of $43.6 million, an increase of $20.8 million, or 91%, compared to $22.8 million in the second quarter ended June 30, 2019.

The Water segment generated total product revenue of $19.3 million for the second quarter ended June 30, 2020, compared to $19.2 million for the second quarter ended June 30, 2019. This increase was due primarily to higher Mega-Project Development ('MPD') and Aftermarket ('AM') shipments offset by lower Original Equipment Manufacturer ('OEM') shipments. We view this stability in the water segment as a real sign of strength as Energy Recovery, and the overall desalination industry, finds its way through this pandemic. MPD has been largely unaffected by global events and continues to be the driver of growth in the desalination industry, and for Energy Recovery.

The Oil & Gas ('O&G') segment generated total revenue of $24.4 million for the second quarter ended June 30, 2020, an increase of $20.8 million, or 582%, compared to $3.6 million for the second quarter ended June 30, 2019. During the three months ended June 30, 2020, the Company and Schlumberger entered into an agreement to terminate the VorTeq License Agreement effective June 1, 2020. As there were no future performance obligations to be recognized under the VorTeq License Agreement, the Company recognized in full the remaining deferred revenue balance of $24.4 million during the quarter. There will be no license and development revenue recognized in future quarters in relation to the VorTeq License Agreement. As a result of the termination of the VorTeq License Agreement, the Company is now free to market the VorTeq™ technology to all companies in the broader pressure pumping market.

Product Gross Margin

For the second quarter ended June 30, 2020, product gross margin was 66.0%, a decrease of 550 basis points from 71.5% in the second quarter ended June 30, 2019. This decrease was due primarily to an increase of $0.7 million, or 370 basis points, in cost of product revenue related to the reduced utilization of the Company's manufacturing facilities during the second quarter prior to the Company's return to full manufacturing in May 2020, as well as the increased overhead costs of the Company's Tracy, California facility. Based on current production levels, the Company does not at this time expect to continue to experience decreases in the product gross margin due to the pandemic.

Operating Expenses

For the second quarter ended June 30, 2020, operating expenses were $15.8 million, an increase of $2.5 million, or 19%, compared to $13.3 million for the second quarter ended June 30, 2019. This increase was due primarily to $2.3 million in impairment expenses of certain long-lived assets that were directly related to the VorTeq License Agreement, continued investment in research and development including O&G testing activities, offset by lower personnel-related costs and travel expenses.

COVID-19 did not have a material effect on operating expenditures during the three months ended June 30, 2020.

Bottom Line Summary

To summarize the Company's financial performance, on a quarterly basis, the Company reported a net income of $16.9 million, or $0.30 per diluted share for the second quarter ended June 30, 2020, compared to a net income of $3.7 million, or $0.07 per diluted share for the second quarter ended June 30, 2019.

Cash Flow Highlights

The Company finished the second quarter ended June 30, 2020 with cash and cash equivalents of $63.0 million, and short-term and long-term investments of $33.9 million, which represents a combined total of $96.9 million.

Forward-Looking Statements

Certain matters discussed in this press release and on the conference call are 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including the Company's belief that there will be increased demand for our technology resulting in growth in our revenue; the Company will be able to generate near-term shareholder value from our VorTeq technology; the Company will be able to monetize the VorTeq technology; the Company we will be able to fulfill our existing delivery obligations in fiscal year 2020 and beyond; and at this time, we will not continue to experience decreases in the product gross margin due to the COVID-19 pandemic. These forward-looking statements are based on information currently available to us and on management's beliefs, assumptions, estimates, or projections and are not guarantees of future events or results. Potential risks and uncertainties include the Company's ability to achieve the milestones under the VorTeq license agreement, any other factors that may have been discussed herein regarding the risks and uncertainties of the Company's business, and the risks discussed under 'Risk Factors' in the Company's Form 10-K filed with the U.S. Securities and Exchange Commission ('SEC') for the year ended December 31, 2019 as well as other reports filed by the Company with the SEC from time to time. Because such forward-looking statements involve risks and uncertainties, the Company's actual results may differ materially from the predictions in these forward-looking statements. All forward-looking statements are made as of today, and the Company assumes no obligation to update such statements.

Conference Call to Discuss Second Quarter 2020 Financial Results

LIVE CONFERENCE CALL:

Thursday, July 30, 2020, 2:00 PM PDT / 5:00 PM EDT

Listen-only, US / Canada Toll-Free: +1 (877) 709-8150

Listen-only, Local / International Toll: +1 (201) 689-8354

Access code: 13704670

CONFERENCE CALL REPLAY:

Expiration: Sunday, August 30, 2020

US / Canada Toll-Free: +1 (877) 660-6853

Local / International Toll: +1 (201) 612-7415

Access code: 13704670

Investors may also access the live call or the replay over the internet at ir.energyrecovery.com. The replay will be available approximately three hours after the live call concludes.

Disclosure Information

Energy Recovery uses the investor relations section on its website as means of complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor Energy Recovery's investor relations website in addition to following Energy Recovery's press releases, SEC filings, and public conference calls and webcasts.

About Energy Recovery Inc.

For more than 20 years, Energy Recovery, Inc. (NASDAQ: ERII) has created technologies that solve complex challenges in industrial fluid-flow markets. We design and manufacture solutions that reduce waste, improve operational efficiencies, and lower the production costs of clean water and oil and gas. What began as a game-changing invention for water desalination has grown into a global business delivering solutions that enable more affordable access to these critical resources. Headquartered in the San Francisco Bay Area, Energy Recovery has manufacturing, research and development facilities across California and Texas. In addition, our worldwide sales and technical service organization provides on-site support for our line of water solutions. For more information, please visit www.energyrecovery.com.

Contact

Investor Relations

[email protected]

(281) 962-8105

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

ENERGY RECOVERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

ENERGY RECOVERY, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(Unaudited)

SOURCE: Energy Recovery Inc.

View source version on accesswire.com:

https://www.accesswire.com/599662/Energy-Recovery-Reports-Second-Quarter-Financial-Results

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Miami Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Miami Mirror.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

International

SectionTragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

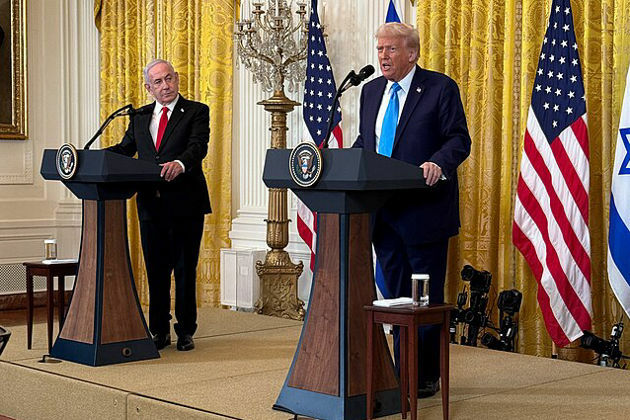

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...