Clough Global Closed-End Funds Announce Share Repurchase Programs

ACCESS Newswire

03 Jun 2023, 03:13 GMT+10

DENVER, CO / ACCESSWIRE / June 2, 2023 / The Boards of Trustees (the 'Boards') of the following closed-end funds (the 'Funds') advised by Clough Capital Partners L.P. (the 'Advisor') announced today that each Fund has approved a share repurchase program under which it may purchase, over a one-year period beginning on June 5, 2023, up to 5% of its outstanding common shares in open market transactions:

- Clough Global Equity Fund (NYSE MKT: GLQ)

- Clough Global Opportunities Fund (NYSE MKT: GLO)

- Clough Global Dividend & Income Fund (NYSE MKT: GLV)

The share repurchase programs are designed to enhance shareholder value by permitting the Funds to purchase their shares when trading at a discount from their net asset value per share. Charles I Clough, Jr., Chairman of the Advisor, commented 'Considering that the Funds traded at a premium as recently as September 2022, we see value in the Funds' ability to repurchase shares at their current discounts to NAV, which can be beneficial for all shareholders.'

The amount and timing of repurchases will be at the discretion of the Advisor, subject to market conditions and investment considerations. There is no assurance that the Funds will purchase shares at any particular discount levels or in any particular amounts. Any repurchases made under these programs will be made on a national securities exchange at the prevailing market price, subject to exchange requirements and volume, timing and other limitations under federal securities laws. The Funds' repurchase activity will be disclosed in the annual and semi-annual reports to shareholders. The Boards will monitor on an ongoing basis the share repurchase programs and continue to consider a range of strategic options to enhance shareholder value in the long-term.

Certain statements made on behalf of the Funds may be considered forward-looking statements. The Funds actual results may differ significantly from those anticipated in any forward-looking statements due to numerous factors, including but not limited to a decline in value in the general markets or the Funds' investments specifically. Neither the Funds nor the Advisor undertake any responsibility to update publicly or revise any forward-looking statement.

Clough Capital Partners L.P.

Clough Capital, which serves as investment adviser to the Funds, is a global multi-strategy alternative asset management firm founded in 1999 that manages over $1.4 billion in assets as of March 31, 2023. Clough Capital employs fundamental research to invest in public and private markets, across various asset classes and manage an array of strategies for its clients. More information is available at www.cloughcapital.com.

An investor should consider the investment objectives, risks, charges and expenses carefully before investing in a Fund. To obtain a Fund's prospectus, annual report or semi-annual report, which contains this and other information visit www.cloughglobal.com or call (855) 425-6844. Read them carefully before investing.

This press release is not a solicitation to buy or sell fund shares. Each Fund is a closed-end fund, which does not continuously issue shares for sale as open-end mutual funds do. Since the initial public offering, each Fund now trades in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker. The share price of a closed-end fund is based on the market's value and often trade at a discount to their net asset value, which can increase an investor's risk of loss. All investments are subject to risk, including the risk of loss.

Inquiries: (855) 425-6844 or [email protected]

SOURCE: Clough Global Closed-End Funds

View source version on accesswire.com:

https://www.accesswire.com/758998/Clough-Global-Closed-End-Funds-Announce-Share-Repurchase-Programs

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Miami Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Miami Mirror.

More InformationBusiness

SectionFoxconn iPhone exports from India now mostly headed to the US

NEW DELHI, India: Amid mounting U.S.-China trade tensions, Apple has sharply increased iPhone shipments from India to the United States,...

US: China lags in AI chips, but catching up fast

WASHINGTON, D.C.: The U.S. government estimates that Huawei will only be able to manufacture up to 200,000 advanced AI chips next year—well...

Chime soars in debut, giving fintech sector a much-needed boost

SAN FRANCISCO, California: After months of muted IPO activity in the fintech world, digital bank Chime Financial reignited investor...

Switch 2 breaks Nintendo record with 3.5M units sold in 4 days

TOKYO, Japan: Nintendo's latest console is off to a roaring start. The company says it has sold over 3.5 million units of the newly...

U.S.-China trade progress lifts oil prices to multi-week peak

LONDON, UK: Crude prices surged this week as investors welcomed fresh signs of progress in U.S.-China relations, lifting hopes of reduced...

Debt fears drive fund outflows from US, inflows to Europe

NEW YORK CITY, New York: Investor confidence in U.S. markets is showing signs of strain as global funds redirect billions toward Europe...

International

SectionAirlines reroute planes after Israeli strikes spark airspace chaos

SEOUL/LONDON: A wave of flight cancellations and diversions swept across the airline industry on June 13 after Israel launched strikes...

Ukraine sea drone success inspires Taiwan defense plans against China

WUSHI, Taiwan: Inspired by how Ukraine has used sea drones effectively against Russia in the Black Sea, Taiwan is learning how to use...

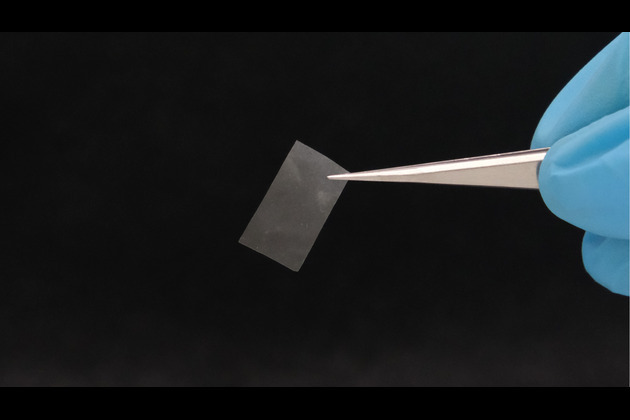

Scientists in Zurich develop living material with unique properties

ZURICH, Switzerland: In a breakthrough that could reshape the future of sustainable materials, scientists at Empa's Cellulose and Wood...

Boeing under scrutiny after deadly Dreamliner crash in India

SEATTLE/BENGALURU: Boeing is once again under scrutiny following the crash of an Air India 787-8 Dreamliner that killed nearly all...

Brian Wilson, legendary Beach Boys cofounder, dies at 82

LOS ANGELES, California: Brian Wilson, the musical genius behind many of the Beach Boys' greatest hits like Good Vibrations and God...

UN nuclear authority 'deeply concerned' about attacks on Iran's nuclear plants

NEW YORK, New York - The head of the International Atomic Energy Agency (IAEA) says it is deeply concerning that Israel is carrying...